One Big Beautiful Bill Act (OBBBA): 10 Business Taxpayer FAQs

Business owners from LLCs to S Corps, C Corps, and partnerships need to understand how the One Big, Beautiful Bill Act (OBBBA) affects deductions, tax credits, and entity selection. This guide offers a detailed breakdown with FAQs to help you plan strategically.

Does the QBI deduction still apply to my business, and did the income phaseouts change?

How are S Corp shareholder distributions affected under OBBBA?

Is there still 100% bonus depreciation? What’s changing?

How will the OBBBA impact my payroll tax obligations or credits?

Are any new credits available for employee training, green energy, or tech upgrades?

Do I need to revisit my business entity type based on the new law?

What changes are being made to net operating loss (NOL) carrybacks/carryforwards?

How do I adjust estimated quarterly payments for 2025 under the new rules?

Are there any new IRS compliance or documentation requirements under OBBBA?

Is there an advantage to offering retirement plans under OBBBA?

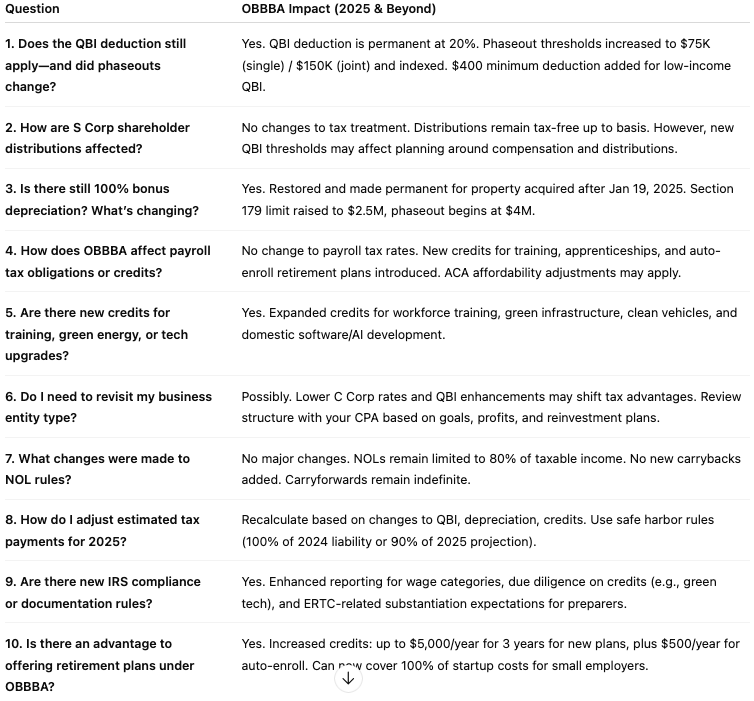

OBBBA Summary Table for Business Owners

Does the QBI deduction still apply to my business, and did the income phaseouts change?

Yes, the Qualified Business Income (QBI) deduction under Section 199A is permanently extended under the OBBBA at the current 20% deduction rate for eligible pass-through entities like S Corps, partnerships, and sole proprietorships.

The income phaseout thresholds have been increased and will now be indexed for inflation:

New phase-in begins at $75,000 (single) and $150,000 (married filing jointly), compared to the original $50K/$100K limits.

A new $400 minimum deduction applies once QBI exceeds $1,000, benefiting low-profit businesses as well.

Specified service trades or businesses (SSTBs) are still subject to phaseouts, but the expanded limits increase planning flexibility.

How are S Corp shareholder distributions affected under OBBBA?

OBBBA does not change the treatment of S Corporation distributions directly.

Shareholders will continue to receive pass-through income reported on Schedule K-1, with distributions tax-free to the extent of basis.

However, since the QBI deduction is now permanent and the thresholds are increased, S Corp owners may see improved benefits if income is kept below new caps.

Advisors should revisit reasonable compensation levels, as wage calculations still affect QBI limits.

Is there still 100% bonus depreciation? What’s changing?

Yes. OBBBA restores and makes permanent 100% bonus depreciation for qualified property acquired and placed in service after January 19, 2025.

This allows businesses to immediately expense the entire cost of qualifying equipment, software, and certain improvements, supporting investment-heavy industries.

Section 179 expensing limits are also increased to $2.5 million, with a phaseout threshold of $4 million.

How will the OBBBA impact my payroll tax obligations or credits?

OBBBA does not change payroll tax rates or filing deadlines, but it introduces new credits tied to employee benefits and wage structures.

Key additions include:

Expanded workforce training and apprenticeship credits

Credits for businesses adopting auto-enroll retirement plans

Updates to health coverage affordability rules, which may affect small employer compliance under ACA reporting

Employers must remain compliant with existing employment tax rules under IRS and Department of Labor guidelines.

Are any new credits available for employee training, green energy, or tech upgrades? Yes. OBBBA introduces several new and expanded credits, including:

Green building improvements and energy-efficient upgrades

Clean vehicle credits for qualifying commercial fleets

Workforce development and upskilling programs for small to midsize businesses

Incentives for AI adoption and domestic software development

Eligibility depends on documentation, employment records, and meeting wage or domestic-use thresholds. Some credits are refundable or transferable.

Do I need to revisit my business entity type based on the new law?

Possibly. While entity tax structures (LLC, S Corp, C Corp, partnership) remain intact, changes in QBI, bonus depreciation, and permanent rate reductions under OBBBA may shift the optimal structure depending on:

Profit margins

Ownership goals

Reinvestment needs

Succession plans

C Corps may become more attractive for businesses reinvesting profits long-term, while S Corps still offer pass-through efficiency. Now is a good time to review your entity with us or your CPA.

What changes are being made to net operating loss (NOL) carrybacks/carryforwards?

OBBBA does not introduce new NOL carryback provisions. The existing rule, limiting NOL deductions to 80% of taxable income and eliminating carrybacks (except in limited cases), remains in place.

NOLs can still be carried forward indefinitely, subject to the 80% limit, but businesses should not expect pre-2020-style refunds or full offsets.

How do I adjust estimated quarterly payments for 2025 under the new rules?

You’ll want to review 2025 quarterly estimates closely.

If the OBBBA changes increase deductions or lower income (via depreciation, QBI, etc.), you may reduce payments. But underpayment penalties still apply if:

You owe $500+ and

Haven’t paid 90% of 2025’s tax OR 100% of 2024’s liability (110% if prior-year AGI > $150K)

Use IRS Form 1040-ES or 1120-W (for corporations) to project obligations. Withholding from retirement distributions or payroll may also be used to “true up” safely.

Are there any new IRS compliance or documentation requirements under OBBBA?

Yes. To support new deductions and credits, businesses may face additional documentation rules, including:

Enhanced reporting for employee wage types (e.g., tip income, overtime tracking)

Verification for green or domestic-use incentives

Additional due diligence standards for tax preparers (especially after ERTC fraud scrutiny)

Expect more use of digital records, AI verification tools, and pre-claim substantiation.

Is there an advantage to offering retirement plans under OBBBA?

Yes. OBBBA increases tax credits for establishing retirement plans, especially for employers with 50 or fewer employees.

Up to $5,000 credit/year for 3 years for startup costs.

An additional $500/year credit for automatic enrollment.

Greater savings if offering SEP, SIMPLE, or 401(k) plans with matching contributions.

Credits can now cover up to 100% of plan startup costs (up from 50%).

This significantly reduces the barrier for small business retirement benefits.

Have Questions About How OBBBA Affects You?

The tax changes introduced under the One Big, Beautiful Bill Act are significant, and navigating them effectively can help you avoid surprises, reduce your tax liability, and take full advantage of new opportunities.

Please contact our office to schedule a consultation. We’re here to help you understand how these updates apply to your unique situation and guide you in making confident, tax-smart decisions for 2025 and beyond.